Food Additive

Global Food Additive Market by Product Type (Acidity Regulators, Sweeteners, Colorants, Flavoring Agents, Emulsifiers, Food Preservatives, Anti-Caking Agents & Others), by Source (Natural & Synthetic), by Application (Bakery & Confectionery, Meat & Meat Products, Beverages, Dairy Products & Others), by Region; Size and Forecast, 2018-2025

- Published Date: September 2018

- Report ID: BWC1822

- Available Format: PDF

- Page: 222

Report Overview

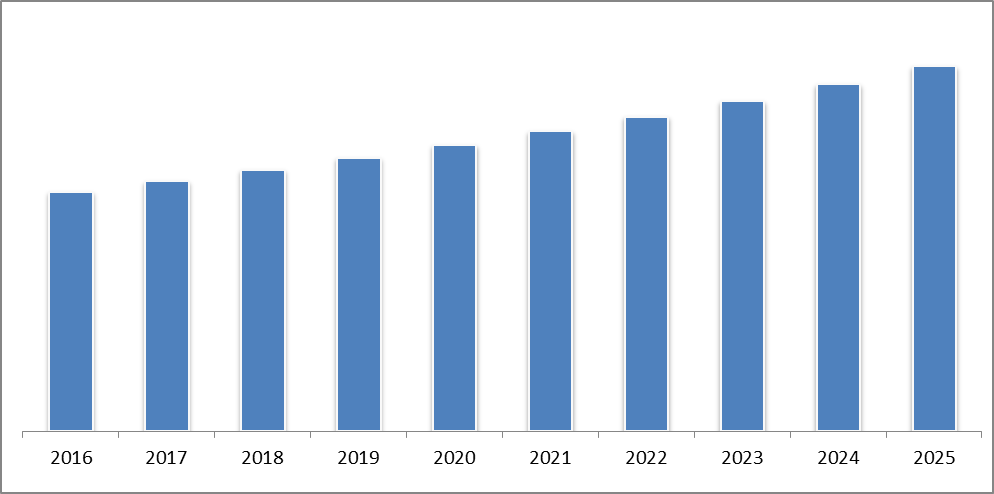

Global Food Additive market report provides analysis for the period 2016–2025, wherein the period from 2018 to 2025 is the forecast period and 2017 is base year. The market study reveals that the global food additive market is expected to record a CAGR of 4.89% during 2018-2025 in terms of value. The market is expected to reach around USD 70 billion by 2025. This growth is driven by numerous reasons such as growing demand for processed and packaged food among consumers across the globe, coupled with technological innovation in the overall Food & Beverage industry.

The market overview section of the report demonstrates market dynamics such as drivers and restraints that talks about the current nature and future scenario of the said market, key market indicators, and raw material analysis. Further, key market indicators included in the report provide the significant factors which are capable to define the market position of the global food additive market. Furthermore, various analysis methods like Porter’s, Pestle are also included in the report to provide an in-depth view of the market scenario.

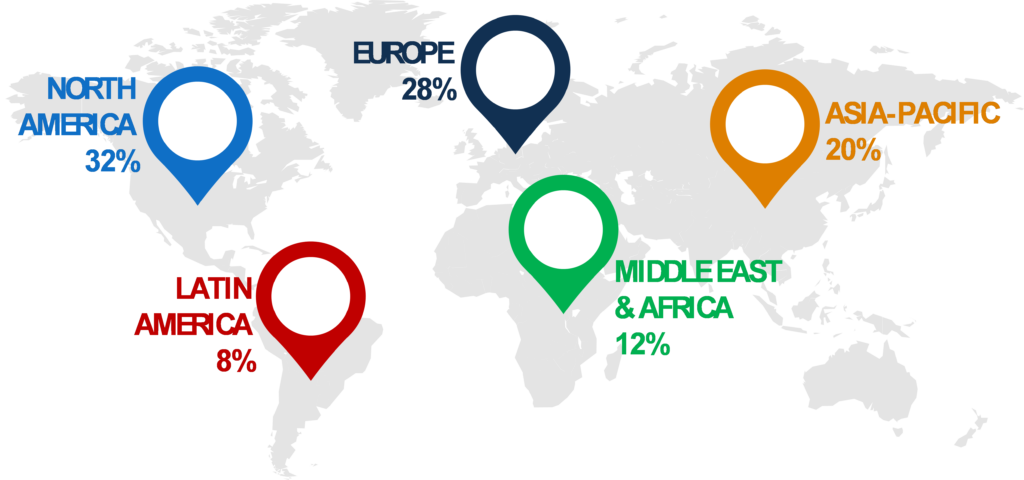

On the basis of the type of product type, the market is segmented into Acidity Regulator, Sweetener, Colorant, Flavoring Agent, Emulsifier, Food Preservative, Anti-Caking & Others. Based on the source of Food Additive, the market is segmented into Natural Source & Synthetic Source. Further, the market is bifurcated into Bakery & Confectionery, Meat & Meat Products, Beverage, Dairy Product & Others. Finally, the report covers the analysis of these segments across North America, Europe, Asia Pacific, Middle East, and Africa & Latin America along with the qualitative analysis for market estimates that boosts the growth of the global food additive market during the forecast period.

The report also highlights the competitive landscape of the global food additive market that includes the company overview, products & offerings, strategic decisions taken by the company, launch of new products, technology landscape, and financial highlights.

·

Cargill Inc.

·

BASF SE

·

Archer Daniel Midland Company

·

Kerry Group

·

DowDupont

· Evonik Industries AG

According to BlueWeave Consulting, the key findings of the report “Global Food Additive Market Size, Share, Development, Growth and Demand Forecast to 2025” are:

·

The demand for global food additive market is

expected to grow a significant rate, during the forecastperiod. Food Additive

is witnessing tremendous growth due to factors as the need for convenience food

like the packaged and processed food that are ready-to-cook and loaded with

food additives to keep them fresh for a longer time. The demand for convenience

food results for increasing disposable income and rapid urbanization in

developing countries, like India & China materials. Global food additive

market is expected to grow over a CAGR of 4.89% & 4.46% by value and volume

respectively, during the forecast period, 2018-2025

·

Flavoring Agents has been the largest revenue

contributor, in terms of value, to the global additive market as compared to

other product types. It is expected to grow with CAGR over 4.80% by value

during the forecast period, 2018-2025

·

Asia Pacific is the fastest growing region in

the Food Additive market and is expected to propel with a CAGR 6.36% by value

and with a CAGR 5.88% by volume during the forecast period, 2018-2025 with

India being the fastest growing market having a CAGR over 7.10% and expected to

reach a revenue of around USD 3.70Billion

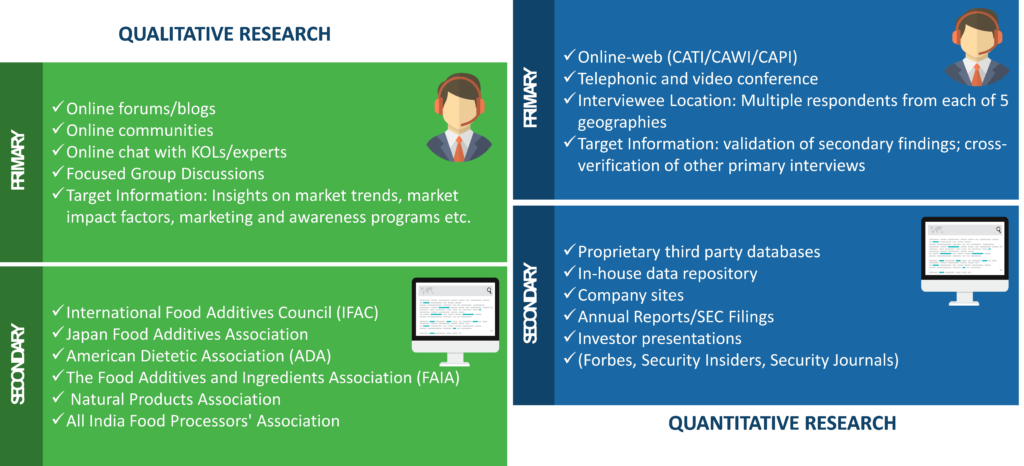

Extensive secondary research was conducted using paid data sources including Bloomberg, Factiva, Capital IQ, OneSource, and Hoovers. Additionally, several publicly-available data sources were used including journals, statistics articles, and industry associations. These data sources were used to gather relevant information to develop an understanding on the global aerosol market. The research was conducted covering the desk research and primary research. Data sources used for primary research included online forums and blogs, CATI/CAWI, CAPI interviews, and video conferences. Additionally, interviews were conducted through connecting with various industry respondents including C-level executives, directors, divisional heads, regional heads, expert consultants, and independent consultants. The primary research was conducted to gain market insights from industry respondents and validate the gathered information through desk research.

The global food additive market is dominated by a number of players in the market, amongst them the major players are Cargill Inc., BASF SE, Archer Daniel Midland Company, etc. Companies in this industry are following different strategies to strengthen their market position. For instance, Archer Daniel Midland Company has acquired Rodelle to magnify its customer offerings with premium and certified organic vanilla products and this will help to gain competitive advantage over others.

1. Research Framework

1.1. Market Definition & Product Overview

2. Assumptions & Research methodology

3. Executive summary

4. Food Additives Industry Insights

4.1. Industry Segmentation

4.2. Industry ecosystem analysis

4.2.1. Vendor matrix

4.2.2. Distribution channel analysis

4.3. Regulatory framework

4.4. Raw material analysis

4.5. Technological Landscape

4.6. Industry impact and forces

4.6.1. Growth drivers

4.6.2. Industry Challenges

4.7. Company market share analysis,2017

4.8. Growth potential analysis,2017

4.9. Porter’s five forces analysis

4.10. PESTEL analysis

5. Global Food Additive Market Overview

5.1. Market size & Forecast

5.1.1. By Value

5.1.2. By Volume

5.2. Market Share & Forecast

5.2.1. By Product Type

5.2.2. By Sources

5.2.3. By Applications

5.2.4. By Region

6. Food Additive Market, By Product Type

6.1. Key Product Trends

6.2. Acidity Regulators

6.2.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.2.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.3. Sweeteners

6.3.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.3.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.4. Colorants

6.4.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.4.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.5. Flavoring Agents

6.5.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.5.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.6. Emulsifiers

6.6.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.6.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.7. Food Preservatives

6.7.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.7.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.8. Processed Food

6.8.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.8.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.9. Anti-Caking Agents

6.9.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.9.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

6.10. Others

6.10.1.Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

6.10.2.Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

7. Food Additive Market, By Sources

7.1. Key sources trends

7.2. Natural

7.2.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

7.2.2. Market estimates & forecast, by region, 2016-2025,(Kilo Tons) (USD Million)

7.3. Synthetic Source

7.3.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

7.3.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

8. Food Additive Market, By Application

8.1. Key application trends

8.2. Bakery & Confectionery

8.2.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

8.2.2. Market estimates & forecast, by region, 2016-2025,(Kilo Tons) (USD Million)

8.3. Meat & Meat Products

8.3.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

8.3.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

8.4. Beverages

8.4.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

8.4.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

8.5. Dairy Products

8.5.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

8.5.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

8.6. Others

8.6.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

8.6.2. Market estimates & forecast, by region, 2016-2025, (Kilo Tons) (USD Million)

9. Food Additive Market, By Region

9.1. Key Regional trends

9.2. North America

9.2.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

9.2.2. Market estimates & forecast by Product type, 2016-2025, (Kilo Tons) (USD Million)

9.2.3. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.2.4. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.2.5. Market estimates & forecast, by country, 2016-2025, (Kilo Tons) (USD Million)

9.3. Europe

9.3.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

9.3.2. Market estimates & forecast by Product type, 2016-2025, (Kilo Tons) (USD Million)

9.3.3. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.3.4. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.3.5. Market estimates & forecast, by country, 2016-2025, (Kilo Tons) (USD Million)

9.4. Asia Pacific

9.4.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

9.4.2. Market estimates & forecast by Product type, 2016-2025, (Kilo Tons) (USD Million)

9.4.3. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.4.4. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.4.5. Market estimates & forecast, by country, 2016-2025, (Kilo Tons) (USD Million)

9.5. Middle East

9.5.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

9.5.2. Market estimates & forecast by Product type, 2016-2025, (Kilo Tons) (USD Million)

9.5.3. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.5.4. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.5.5. Market estimates & forecast, by country, 2016-2025, (Kilo Tons) (USD Million)

9.6. Africa

9.6.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

9.6.2. Market estimates & forecast by Product type, 2016-2025, (Kilo Tons) (USD Million)

9.6.3. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.6.4. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.6.5. Market estimates & forecast, by country, 2016-2025, (Kilo Tons) (USD Million)

9.7. LATAM

9.7.1. Market estimates & forecast, 2016-2025, (Kilo Tons) (USD Million)

9.7.2. Market estimates & forecast by Product type, 2016-2025, (Kilo Tons) (USD Million)

9.7.3. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.7.4. Market estimates & forecast, by Sources, 2016-2025, (Kilo Tons) (USD Million)

9.7.5. Market estimates & forecast, by country, 2016-2025, (Kilo Tons) (USD Million)

10. Company profile

10.1. CARGIL INC.

10.1.1. Company Overview

10.1.2. Financial Matrix

10.1.3. Key Product landscape

10.1.4. Key Personnel

10.1.5. Key Competitors

10.1.6. Contact Address

10.1.7. SWOT Analysis

10.1.8. Strategic Outlook

10.2. BASF SE

10.2.1. Company Overview

10.2.2. Financial Matrix

10.2.3. Key Product landscape

10.2.4. Key Personnel

10.2.5. Key Competitors

10.2.6. Contact Address

10.2.7. SWOT Analysis

10.3. ARCHER DANIEL MIDLAND COMPANY

10.3.1. Company Overview

10.3.2. Financial Matrix

10.3.3. Key Product landscape

10.3.4. Key Personnel

10.3.5. Key Competitors

10.3.6. Contact Address

10.3.7. SWOT Analysis

10.4. DUPONT

10.4.1. Company Overview

10.4.2. Financial Matrix

10.4.3. Key Product landscape

10.4.4. Key Personnel

10.4.5. Key Competitors

10.4.6. Contact Address

10.4.7. SWOT Analysis

10.5. KERRY GROUP

10.5.1. Company Overview

10.5.2. Financial Matrix

10.5.3. Key Product landscape

10.5.4. Key Personnel

10.5.5. Key Competitors

10.5.6. Contact Address

10.5.7. SWOT Analysis

10.6. EVONIK INDUSTRIES AG

10.6.1. Company Overview

10.6.2. Financial Matrix

10.6.3. Key Product landscape

10.6.4. Key Personnel

10.6.5. Key Competitors

10.6.6. Contact Address

10.6.7. SWOT Analysis

10.7. INGEDION INCORPORATED

10.7.1. Company Overview

10.7.2. Financial Matrix

10.7.3. Key Product landscape

10.7.4. Key Personnel

10.7.5. Key Competitors

10.7.6. Contact Address

10.7.7. SWOT Analysis

10.8. TATE & LYLE PLC

10.8.1. Company Overview

10.8.2. Financial Matrix

10.8.3. Key Product landscape

10.8.4. Key Personnel

10.8.5. Key Competitors

10.8.6. Contact Address

10.8.7. SWOT Analysis

10.9. CHR HANSEN HOLDING A/S

10.9.1. Company Overview

10.9.2. Financial Matrix

10.9.3. Key Product landscape

10.9.4. Key Personnel

10.9.5. Key Competitors

10.9.6. Contact Address

10.9.7. SWOT Analysis

10.10. NOVOZYMES A/S

10.10.1. Company Overview

10.10.2. Financial Matrix

10.10.3. Key Product landscape

10.10.4. Key Personnel

10.10.5. Key Competitors

10.10.6. Contact Address

10.10.7. SWOT Analysis

Market Segmentation

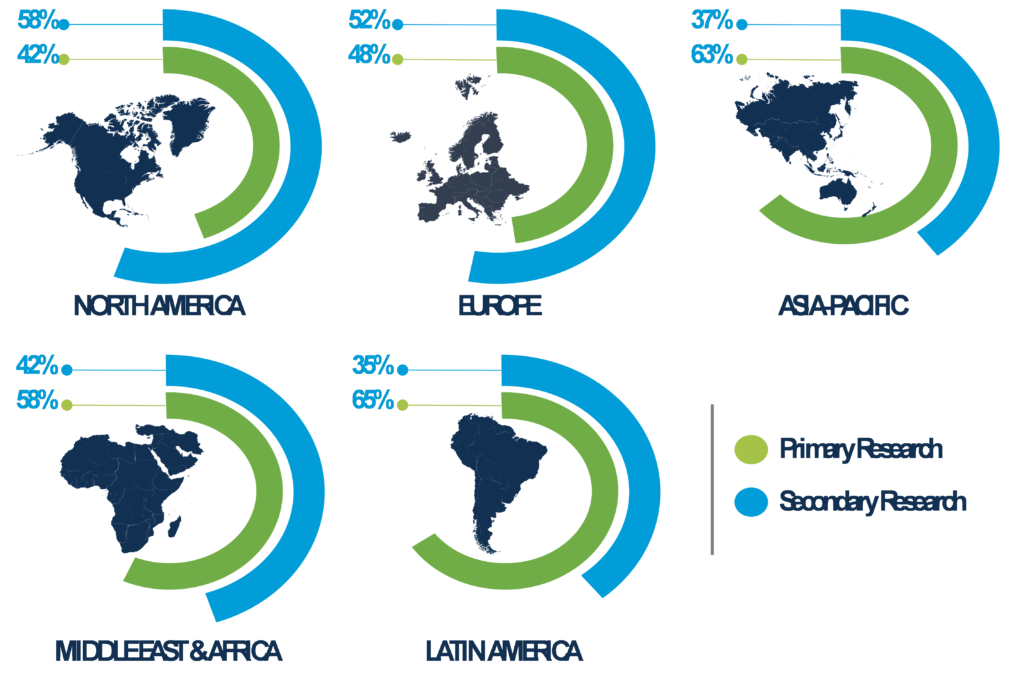

2. Regional Split of Primary & Secondary Research

3. Secondary Research

The research process began with obtaining historical market sizes of the entire food additives market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the food additives market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the food additive industry were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes.

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by product type, by application.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Coustom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.