Residential Security Market

Global Residential Security Market By Product (Security Cameras, Smart Locks, Sensors, Security Alarms, Fire Sprinklers And Extinguishers), By Solution (Audio-Visual Surveillance, Control & Management, Home Integrated Security, Alert System, Intercom System, Fire Protection) By Home Type (Independent And Apartments) Size And Forecast To 2018-2024

- Published Date: July 2018

- Report ID: BWC1810

- Available Format: PDF

- Page: 203

Report Overview

Lucrative opportunities which firms a positive future of the Global Residential Security Market include the introduction of predictive intelligence in Residential security solutions and growth in the do it yourself (DIY) security solutions. Emerging trends which promises a continuous growth of the global Residential security market comprises of rapid emergence of the wireless residential security which acts as a status trend in many developing regions. The future of the global Residential security market is predicted to be attractive with an increasing number of threats in the residential sector across the globe. As per the study, the market is estimated to reach above USD 67,588 million by 2024. On the account of substantial development in technologies, such as the Internet of Things (IoT), adoption of cloud based security technologies and rapid increase in demand for advanced security solutions, like alert systems and wireless locks, this market is gaining more traction.

Global Residential Security Market: Key Stakeholders

·

Security Equipment Providers

·

Industrial & Home Security Providers

·

Software & Hardware Providers

·

Electrical & Electronic Device Suppliers

·

Telecommunication Providers

·

Cloud Service Providers

·

Professional & Managed Service Providers

·

Real Estate Builders

·

Safety Standard Providers

·

Investors

Global Residential Security Market Insights:

According to BlueWeave Consulting, the key findings of the report “Global Residential Security Market Size, Share, Development, Growth and Demand Forecast to 2024” are:

·

As per the research, sale of security cameras

was highest amongst other residential security products. Further, security

camera segment is expected to continue with its highest revenue contribution

during the forecast period. Security cameras are one of the fundamental devices

for Residential security, which are purchased by every Residential owner who

wants to immune their property against unexpected intrusions.

·

Among various solutions, demand for audio visual

surveillance segment witnessed the highest growth during 2014-2017. However,

Residential integrated security segment is anticipated to lead the market with

highest growth rate, during the forecast period. Among smart locks, electronic

door locks contributed highest revenue to the global market, however, the sales

of next generation wireless locks is expected to grow fastest in the coming

years

·

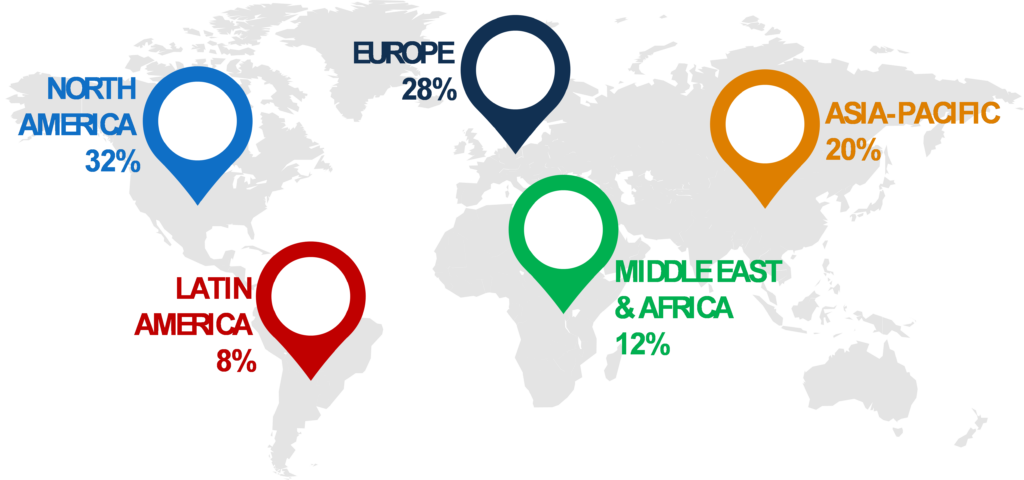

North America has been the largest market for

Residential security due to mass adoption of Residential security solutions by

the citizens, and an updated mindset for securing their Residential with

security solutions

·

Asia-Pacific is likely to grow fastest among all

regions, during the forecast period. The anticipated growth of Asia-Pacific

market is due to digitalization, advancement in new technologies, growth in

security equipment industry, and increasing adoption of connected technologies

such as Internet of Things (IoT) by Residential security providers in countries

like India, China, and Singapore

·

In addition to this, with several government

initiatives for instance development of smart city projects, the Asia-Pacific

Residential security market has high propensity to witness a rapid scale of

revenue generation in near future.

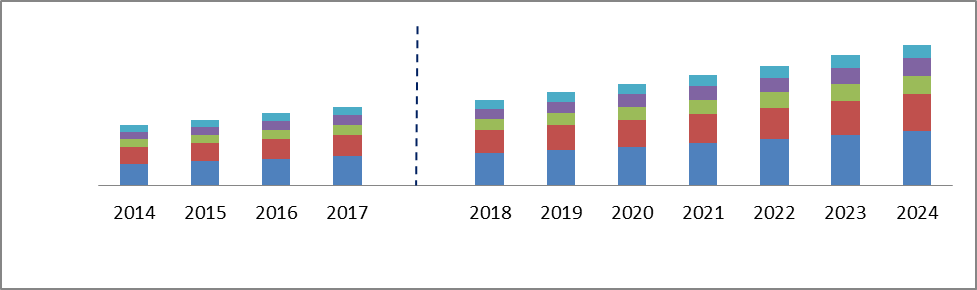

Global Residential Security Market, Revenue Forecast, USD (Million), 2014-2024

Global Residential Security Market: Research Methodology

Extensive secondary research was conducted using paid data sources including Bloomberg, Factiva, Capital IQ, OneSource, and Hoovers. Additionally, several publicly-available data sources were used including journals, statistics articles, and industry associations. These data sources were used to gather relevant information to develop an understanding of the global residential security market. The research was conducted covering desk research and primary research. Data sources used for primary research included online forums and blogs, CATI/CAWI, CAPI interviews, and video conferences. Additionally, interviews were conducted through connecting with various industry respondents including C-level executives, directors, divisional heads, regional heads, expert consultants, and independent consultants. The primary research was conducted to gain market insights from industry respondents and validate the gathered information through desk research.

Global Residential Security Market: Competitive Dynamics

The research states that the global Residential security market is highly competitive, with players developing new Residential security applications and smart security solutions. Some of the key players in the global Residential security ecosystem are Bosch Security Systems Inc, Honeywell Security Group, Alarm.Com, Allegion PLC, Ingersoll Rand, Nortek Security & Control LLC, United Technologies Corporation, Control4 Corporation, and Godrej & Boyce Mfg. Co. Ltd.

1.

Research

Overview

1.1.

Objectives of the study

1.2.

Market Definition

1.3.

Market Coverage/ Scope

1.3.1.

Segmentation by Product

1.3.2.

Segmentation by Solution

1.3.3.

Segmentation by

Residential Type

1.3.4.

Segmentation by Region

1.3.5.

Analysis Period of the

study

1.3.6.

Data units

1.4.

Key

Participants/Stakeholder

2.

Research

Methodology

2.1.

Secondary Research

2.2.

Primary Research

2.2.1.

Primary Research

Participants

2.2.1.1.

By Region

2.2.1.2.

By Industry

2.3.

Market Size Estimation

2.4.

Assumptions for the

Study

2.5.

Market Breakdown and

Data Triangulation

3.

Executive

Summary

4.

Introduction

4.1.

Classification of Market

4.1.1.

Overview by

Product

4.1.1.1.

Security cameras

4.1.1.2.

Smart locks

4.1.1.3.

Sensors

4.1.1.4.

Security alarms

4.1.1.5.

Fire sprinklers &

extinguishers

4.1.2.

Overview By Solution

4.1.2.1.

Audio-visual

surveillance

4.1.2.2.

Access control &

management

4.1.2.3.

Home integrated security

4.1.2.4.

Alert system

4.1.2.5.

Intercom system

4.1.2.6.

Fire protection

4.1.3.

Overview By Residential

Type

4.1.3.1.

Independent

4.1.3.2.

Apartment

4.2.

Value Chain Analysis

4.3.

Market Dynamics

4.3.1.

Trends

4.3.1.1.

Emergence of wireless

home security

4.3.1.2.

Remote monitoring

residential security systems

4.3.1.3.

Home automation &

residential security as a status trend

4.3.2.

Drivers

4.3.2.1.

Increasing penetration

of IoT in home security

4.3.2.2.

Amplified adoption of

smart security in the residential sector

4.3.2.3.

Entry of multiple system

operators in the global market

4.3.2.4.

Impact analysis of

drivers on market forecast

4.3.3.

Restraints

4.3.3.1.

Threat to user privacy

4.3.3.2.

High cost of residential

security solutions

4.3.3.3.

Lack of awareness and

confusion over choosing the right solution

4.3.3.4.

Impact analysis of

restraints on market forecast

4.3.4.

Opportunities

4.3.4.1.

Predictive intelligence

in residential security

4.3.4.2.

Growth in DIY

residential security solutions

4.4.

Porter’s Five Forces of

Competitive Position Analysis

4.4.1.

Bargaining Power of

Buyers

4.4.2.

Bargaining Power of

Suppliers

4.4.3.

Threat of New Entrants

4.4.4.

Threat of Substitutes

4.4.5.

Intensity of Rivalry

5.

Market

Size and Forecast by Product

5.1.

Global Residential

Security Cameras Market

5.1.1.

By Region

5.2.

Global Residential Smart

Locks Market

5.2.1.

By Type

5.2.2.

By Region

5.3.

Global Residential

Sensors Market

5.3.1.

By Region

5.4.

Global Residential

Security Alarms Market

5.4.1.

By Region

5.5.

Global Residential Fire

Sprinklers & Extinguishers Market

5.5.1.

By Region

6.

Market

Size and Forecast by Solution

6.1.

Global Residential

Audio-Visual Surveillance Market

6.1.1.

By Region

6.2.

Global Residential

Access Control & Management Market

6.2.1.

By Region

6.3.

Global Residential

Integrated Security Market

6.3.1.

By Region

6.4.

Global Residential Alert

System Market

6.4.1.

By Region

6.5.

Global Residential

Intercom System Market

6.5.1.

By Region

6.6.

Global Residential Fire

Protection Market

6.6.1.

By Region

7.

Market

Size and Forecast by Residential Type

7.1.

Global Residential

Security Market for Independent

7.1.1.

By Region

7.2.

Global Residential

Security Market for Apartment

7.2.1.

By Region

8.

Market

Size and Forecast by Geography

8.1.

North America

Residential Security Market

8.1.1.

By Product

8.1.1.1.

By type

8.1.2.

By Solution

8.1.3.

By Residential-Type

8.1.4.

By Country

8.1.4.1.

U.S.

8.1.4.2.

Canada

8.2.

Europe Residential

Security Market

8.2.1.

By Product

8.2.1.1.

Residential Security

Smart Locks Market, by Type

8.2.2.

By Solution

8.2.3.

By Residential Type

8.2.4.

By Country

8.2.4.1.

U.K.

8.2.4.2.

Russia

8.2.4.3.

Germany

8.2.4.4.

France

8.2.4.5.

Italy

8.2.4.6.

Spain

8.3.

Latin America

Residential Security Market

8.3.1.

By Product

8.3.1.1.

Latin America

residential security smart locks market, by type

8.3.2.

By Solution

8.3.3.

By Residential Type

8.3.4.

By Country

8.3.4.1.

Brazil

8.3.4.2.

Argentina

8.3.4.3.

Colombia

8.4.

Asia-Pacific Residential

Security Market

8.4.1.

By Product

8.4.1.1.

Residential Security

Smart Locks Market, by Type

8.4.2.

By Solution

8.4.3.

By Residential Type

8.4.4.

By Country

8.4.4.1.

China

8.4.4.2.

Japan

8.4.4.3.

India

8.4.4.4.

South Korea

8.4.4.5.

Australia

8.5.

MEA Residential Security

Market

8.5.1.

By Product

8.5.1.1.

Residential Security

Smart Locks Market, by Type

8.5.2.

By Solution

8.5.3.

By Residential Type

8.5.4.

By Country

8.5.4.1.

U.A.E.

8.5.4.2.

South Africa

8.5.4.3.

Israel

8.5.4.4.

Saudi Arabia

9.

Competitive

Landscape

9.1.

Recent Activities of Key

Players

9.2.

Recent Strategic

Developments of Key Players

9.2.1.

Merger & Acquisition

9.2.2.

Partnership

9.2.3.

Product Launch

9.2.4.

Other Developments

10.

Company

Profiles

10.1.

Bosch Security Systems

10.1.1.

Business Overview

10.1.2.

Product and Service

Offerings

10.1.3.

Strategic Growth Plans

10.2.

Honeywell International

Inc.

10.2.1.

Business Overview

10.2.2.

Product and Service

Offerings

10.2.3.

Key Financial Summary

10.2.4.

Strategic Growth Plans

10.3.

ALARM.COM HOLDINGS INC.

10.3.1.

Business Overview

10.3.2.

Product and Service

Offerings

10.3.3.

Key Financial Summary

10.3.4.

Strategic Growth Plans

10.4.

NORTEK SECURITY &

CONTROL, LLC

10.4.1.

Business Overview

10.4.2.

Product and Service

Offerings

10.4.3.

Strategic Growth Plans

10.5.

ALLEGION PLC

10.5.1.

Business Overview

10.5.2.

Product and Service

Offerings

10.5.3.

Key Financial Summary

10.5.4.

Strategic Growth Plans

10.6.

United Technologies

Corporation

10.6.1.

Business Overview

10.6.2.

Product and Service

Offerings

10.6.3.

Key Financial Summary

10.6.4.

Strategic Growth Plans

10.7.

INGERSOLL-RAND PLC

10.7.1.

Business Overview

10.7.2.

Product and Service

Offerings

10.7.3.

Key Financial Summary

10.7.4.

Strategic Growth Plans

10.8.

CONTROL4 CORPORATION

10.8.1.

Business Overview

10.8.2.

Product and Service

Offerings

10.8.3.

Key Financial Summary

10.8.4.

Strategic Growth Plans

10.9.

GODREJ & BOYCE MFG.

CO. LTD.

10.9.1.

Business Overview

10.9.2.

Product and Service

Offerings

10.9.3.

Key Financial Summar

10.10 THE ADT CORPORATION

10.10.1.

Business Overview

10.10.2.

Product and Service Offerings

10.10.3.

Strategic Growth Plans

10.11.

Frontpoint Security

Solutions

10.11.1.

Business Overview

10.11.2.

Product and Service Offerings

11.

Strategic

Recommendations

12.

Appendix

12.1.

Abbreviations

Market Segmentation

1. Research Methodology

2. Regional Split of Primary & Secondary Research

3. Secondary Research

The research process began with obtaining historical market sizes of the entire residential security market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the residential security market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global residential security market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes.

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by process and by industry. An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Coustom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.