Global Retail Cloud Market

Global Retail Cloud Market, By Solution Software And Services), By Model (SaaS, PaaS And IaaS, By Deployment (Public, Hybrid And Private) By Enterprise Size (Small And Medium & Large); Size, Forecast & Opportunities, 2018-2024.

- Published Date: July 2018

- Report ID: BWC1811

- Available Format: PDF

- Page: 210

Report Overview

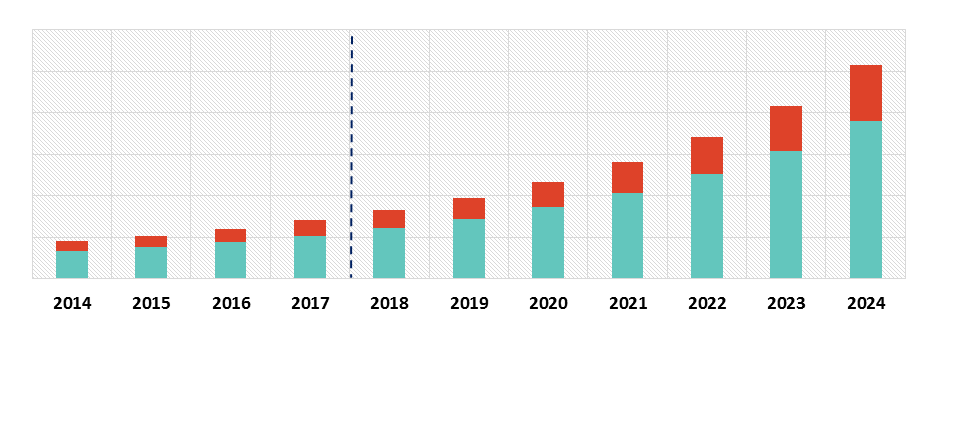

The global retail cloud market is expected to cross USD 50,000 million by 2024, at a CAGR over 20% during the forecast period 2018-2024. Significant growth in cloud-based retail business has been one of the key factors which escalate this market growth. Cloud based business help retailers in supply chain processes. Investment in cloud collaboration platforms helps business in capturing real time order status information, streamline inventories, track product deliverables, and effectively a collection of critical market data from consumers.

Apart from this, rise in availability and popularity of cloud POS systems which is necessary for most retailers has backed the strong growth of this industry. From past decade, cloud POS systems gained traction due to its increasing benefits and reducing cost. Cloud POS offer centralization of customer, sales, and inventory information on central cloud storage. In addition, cloud POS also empowers retailers with real-time transactional information which is accessible from anywhere.

Fast pace developments in cloud technologies are allowing low-cost software production, with swift deployment due to the emergence of technologies such as microservices, continuous integration and continuous deployment (CI/CD), and containers. This has also led to increase in development of advance and deployed friendly retail cloud solutions over the years. The fast-moving nature of the retail industry is seamlessly aligning itself with the new mobile ecommerce solutions, and others new functionalities that can be deployed easily and will be quick without any risk of business failure.

According the researchers of BWC, the key findings of the report “Global Retail Cloud Market Size, Share, Development, Growth and Demand Forecast to 2024” are:

·

As per the findings of the research, software

category led the global retail cloud market in 2017 as compared to service. It

is expected to continue its strong market hold for full software suit systems

by various small and medium enterprises, which lacks technical staff and

capital for cloud transition

·

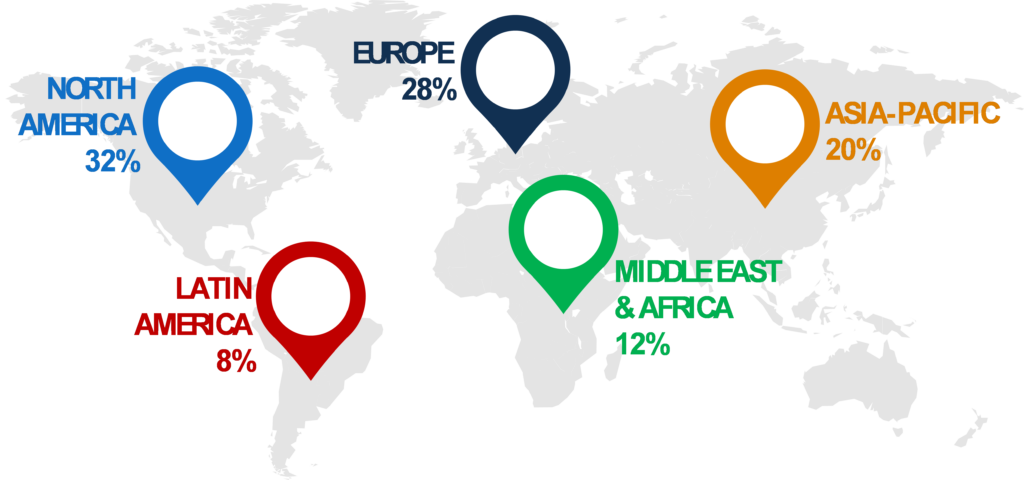

North America has been the largest revenue

contributor to this market. According to the research, Market in North America

is expected to flourish over a longer period on the edge of robust

infrastructure. India is expected to grow fastest among all countries, in

Asia-Pacific retail cloud market, during the forecast period. The high growth

is attributed to factors such as growth in IT in retail industry, adoption of

advance cloud-based solutions by small retail players, improvement in cloud

platform services, and increasing competition in the regional market for

customer satisfaction services by retail players

·

The growth in demand for retail cloud solutions

has made its provider focus on differentiated products, mainly based on the

latest technology features such as cloud-based real-time tracking and efficient

supply chain management

The global retail cloud market is driven by rapid adoption of smart devices and an increase in demand for compliance and collaboration. Significant growth in the number of players entering into the retail cloud market and offering advanced cloud computing solutions has boosted the demand of retail cloud solutions in the recent years. The high cost and risk of switching to retail cloud solutions and growing security and privacy concerns act as a hindrance in the growth of this market. However, software defined retail infrastructure act as a huge opportunity for the global market to grow potentially in the coming years. Some major trends observed in the global retail cloud market include retail business transitioning to cloud, the emergence of personalizeddistribution channel, availability of multiple payment options, and inventory management through end-to-end decision making. The growth in demand for retail cloud solutions has made its provider focus on differentiated products, mainly based on the latest technology features such as cloud-based real-time tracking, and efficient supply chain management. Many organic and inorganic strategic developments are also being witnessed in this industry.

In the recent past, partnership and agreements have been the major recent activities in the global retail cloud market. Large players have been observed as the forerunner in the recent strategic developments. Players such as Oracle and IBM are focusing on increasing their cloud offerings by entering into a strategic alliance with small and medium scale software and service providers. In August 2018 – JDA announced its strategic partnership with Microsoft to enable JDA build cognitive SaaS solutions on the market-leading Microsoft Azure cloud platform. The partnership aims to accelerate JDA’s vision in delivering an autonomous supply chain through an infusion of advanced, intelligent cloud platform capabilities. Some of the major players in this industry are Epicor Software Corporation, SAP SE, IBM, Microsoft Corporation, Oracle Corporation, Infor, Retail Cloud, and, Cisco Systems Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary

4. Market Overview

5. Value Chain Analysis

6. Market dynamics

6.1. Trends

6.2. Drivers

6.3. Restraints

7. Porter’s five Force Analysis

8. Market Size and Forecast

8.1. Market Size and Forecast, by solution

8.1.1. Global retail cloud market, BY solution, $M (2014 – 2024)

8.2. Retail Cloud Software Market Size and Forecast, by Type

8.2.1. Global retail cloud software market, BY Type, $M (2014 – 2024)

8.3. Retail Cloud Service Market Size and Forecast, by Type

8.3.1 Global retail cloud Service market, BY Type, $M (2014 – 2024)

8.4. Software Market Size and Forecast, by Region

8.4.1 Global retail cloud software market, BY region, $M (2014 – 2024)

8.5. Service Market Size and Forecast, by Region

8.5.1 Global retail cloud Service market, BY region, $M (2014 – 2024)

8.6. Market Size and Forecast, by Model

8.6.1 Global retail cloud market, BY model, $M (2014 – 2024)

8.7. SaaS Market Size and Forecast, by Region

8.7.1 Global SaaS retail cloud model market, BY region, $M (2014 – 2024)

8.8. PaaS Market Size and Forecast, by Region

8.8.1 Global PaaS retail cloud model market, BY region, $M (2014 – 2024)

8.9. IaaS Market Size and Forecast, by Region

8.9.1 Global IaaS retail cloud model market, BY region, $M (2014 – 2024)

8.10. Market Size and Forecast, by Deployment

8.10.1 Global retail cloud market, BY deployment, $M (2014 – 2024)

8.11. Public Retail Cloud Market, and Forecast, by Region

8.11.1 Global public retail cloud market, BY region, $M (2014 – 2024)

8.12. Hybrid Retail Cloud Market, and Forecast, by Region

8.12.1 Global hybrid retail cloud market, BY region, $M (2014 – 2024)

8.13. Private Retail Cloud Market, and Forecast, by Region

8.13.1 Global private retail cloud market, BY region, $M (2014 – 2024)

8.14 Retail Cloud Market from SMEs, and Forecast, by Region

8.14.1. Global retail cloud market from SMEs, BY region, $M (2014 – 2024)

8.15. Retail Cloud Market from Large Enterprise, and Forecast, by Region

8.15.1. Global retail cloud market from large enterprise, BY region, $M (2014 – 2024)

8.16 Market Size and Forecast, by Geography

9. Market Size and Forecast North America

9.1. North America Market Size and Forecast, by Solution

9.1.1 North America retail cloud market, BY solution, $M (2014 – 2024)

9.2 North America Retail Cloud Market Size and Forecast, by Type

9.2.1 North America Retail Cloud Software Market, by Type, $M(2014-2014)

9.3 North America Retail Cloud Service Market Size and Forecast, by Type

9.3.1 North America retail cloud market, BY model, $M (2014 – 2024)

9.4 9.4North America Market Size and Forecast, by Model

9.4.1 North America retail cloud market, by model, $M (2014-2024)

9.5 North America Market Size and Forecast, by Deployment

9.5.1 North America retail cloud market, BY deployment, $M (2014 – 2024)

9.6 North America Market Size and Forecast, by Enterprise Size

9.6.1 North America retail cloud Market, by Enterprise Size

9.7 North America Market Size and Forecast, by Country

9.7.1 North America retail cloud market, BY country, $M (2014 – 2024)

10. Market Size and Forecast Europe

10.1. Europe Market Size and Forecast, by Solution

10.1.1 Europe retail cloud market, BY solution, $M (2014 – 2024)

10.2. Europe Retail Cloud Software Market Size and Forecast, by Type

10.2.1 Europe retail cloud software market, BY type, $M (2014 – 2024)

10.3. Europe Retail Cloud service Market Size and Forecast, by Type

10.3.1 Europe retail cloud service market, BY type, $M (2014 – 2024)

10.4 Europe Retail Cloud service Market Size and Forecast, by Model

10.4.1 Europe retail cloud market, BY Model, $M (2014 – 2024)

10.5 Europe Retail Cloud service Market Size and Forecast, by Deployment

10.5.1 Europe retail cloud market, BY Model, $M (2014 – 2024)

10.6 Europe Retail Cloud service Market Size and Forecast, by Enterprise Size

10.6.1 Europe retail cloud market, BY Model, $M (2014 – 2024)

10.7 Europe Retail Cloud service Market Size and Forecast, by Country

10.7.1 Europe retail cloud market, BY Country, $M (2014 – 2024)

11 Market Size and Forecast Asia Pacific

11.1 Asia Pacific Retail Cloud service Market Size and Forecast, by Solution

11.1.1 Asia Pacific retail cloud service market, BY Solution, $M (2014 – 2024)

11.2. Asia Pacific Retail Cloud service Market Size and Forecast, by Type

11.2.1 Asia Pacific retail cloud service market, BY type, $M (2014 – 2024)

11.3 Asia Pacific Retail Cloud software Market Size and Forecast, by Type

11.3.1 Asia Pacific retail cloud software market, BY type, $M (2014 – 2024)

11.4. Asia Pacific Market Size and Forecast, by Model

11.4.1 Asia Pacific retail cloud market, BY model, $M (2014 – 2024)

11.5. Asia Pacific Market Size and Forecast, by Deployment

11.5.1 Asia Pacific retail cloud market, BY deployment, $M (2014 – 2024)

11.6 Asia Pacific Market Size and Forecast, by Enterprise

11.6.1 Asia Pacific retail cloud market, BY enterprise, $M (2014 – 2024)

11.7 Asia Pacific Market Size and Forecast, by Country

11.7.1 Asia Pacific retail cloud market, BY, $M (2014 – 2024)

12.

Market Size and Forecast Latin America

12.1

Latin America Market Size and Forecast, by Solution

12.1.1 Latin

America retail cloud market, BY solution, $M (2013 – 2024)

12.2.

Latin America Retail Cloud Software Market Size and Forecast, by Type

12.2.1 Latin

America retail cloud software market, BY type, $M (2013 – 2024)

12.3.

Latin America Retail Cloud service Market Size and Forecast, by Type

12.3.1 Latin

America retail cloud service market, BY type, $M (2013 – 2024)

12.4.

Latin America Market Size and Forecast, by Model

12.4.1 Latin

America retail cloud market, BY model, $M (2013 – 2024)

12.5.

Latin America Market Size and Forecast, by Deployment

12.5.1 Latin

America retail cloud market, BY deployment, $M (2013 – 2024

12.6.

Latin America Market Size and Forecast, by Enterprise Size

12.6.1 Latin

America retail cloud market, BY enterprise size, $M (2013 – 2024)

12.7.

Latin America Market Size and Forecast, by Country

12.7.1 Latin

America retail cloud market, BY country, $M (2013 – 2024)

13.

Market Competitive

13.1.

Recent Activities of Key Players

13.2

Partnership & Agreement

13.3.

Product Launch

14.

Company Profile

14.1.

SAP SE

14.2.

IBM CORPORATION

14.3.

Cisco Systems, Inc.

14.4.

Oracle Corporation

14.5.

RetailCloud

14.6.

Infor, Inc.

14.7.

Retail Solutions Inc.

14.8.

RapidScale

14.9.

Fujitsu Limited

14.10. JDA

Software Group, Inc.

15.

Abbreviations

Market Segmentation

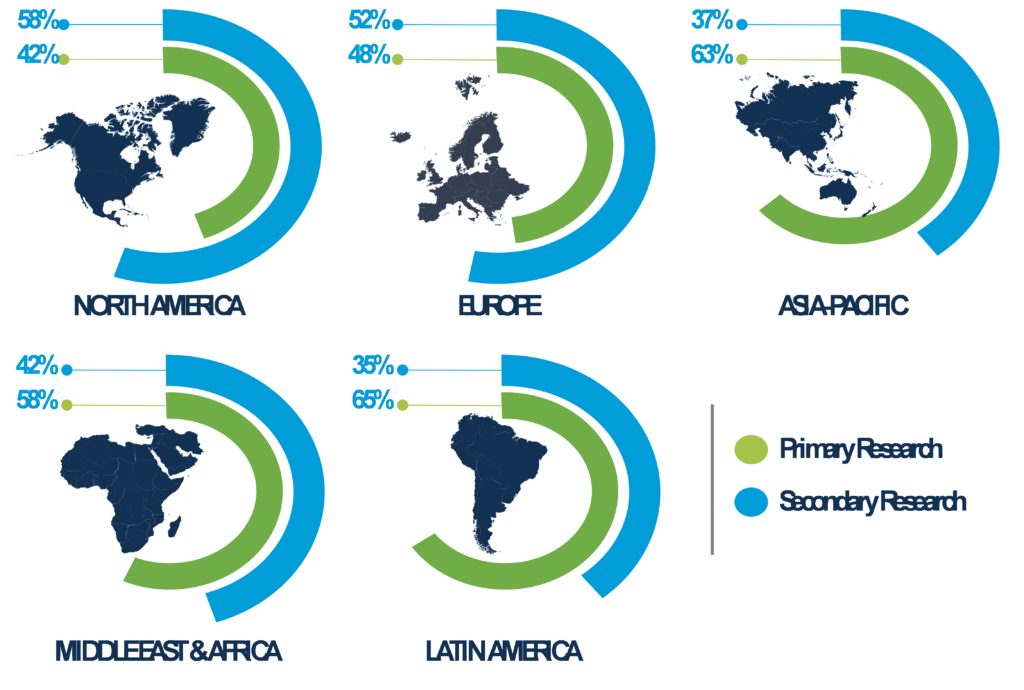

2. Regional Split of Primary & Secondary Research

3. Secondary Research

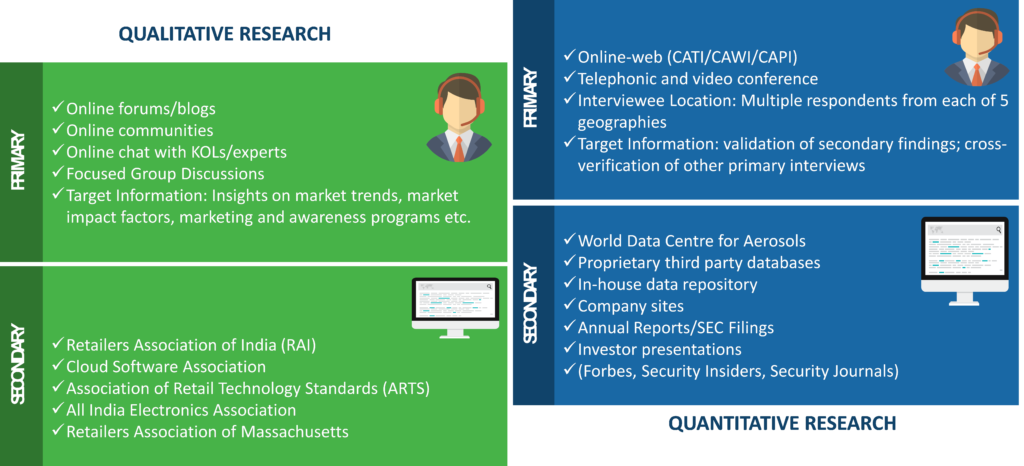

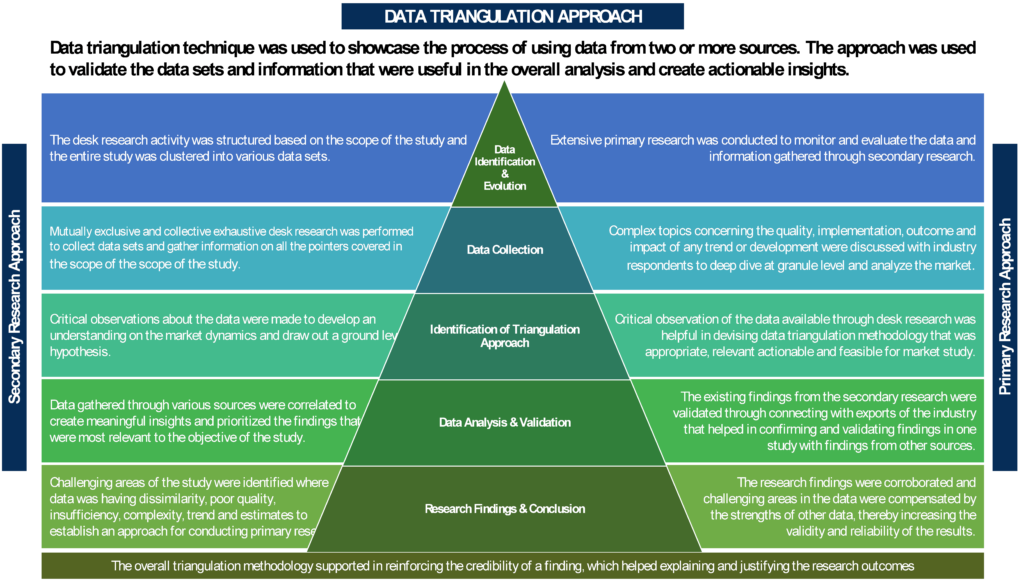

The research process began with obtaining historical market sizes of the entire retail cloud market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the retail cloud market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global retail cloud market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by solution and by model.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

7. Market Breakdown & Data Triangulation

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Coustom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.